University Projects

My University Projects

This page contains the various projects I completed during San Jose State University, and De Anza Community College. Summaries for each of the projects are listed below with the skills I learned and the concepts that were covered with each of these projects.

- Each project file link will be located at the bottom of the webpage in the “Appendix” section.

Microsoft Excel Projects:

- Household Budget - Accounting Principles

- Video Game Simulation - Simulation Theory

- Covariance Analysis - Portfolio Management

- German Study Abroad Program Overview & THI Final Project

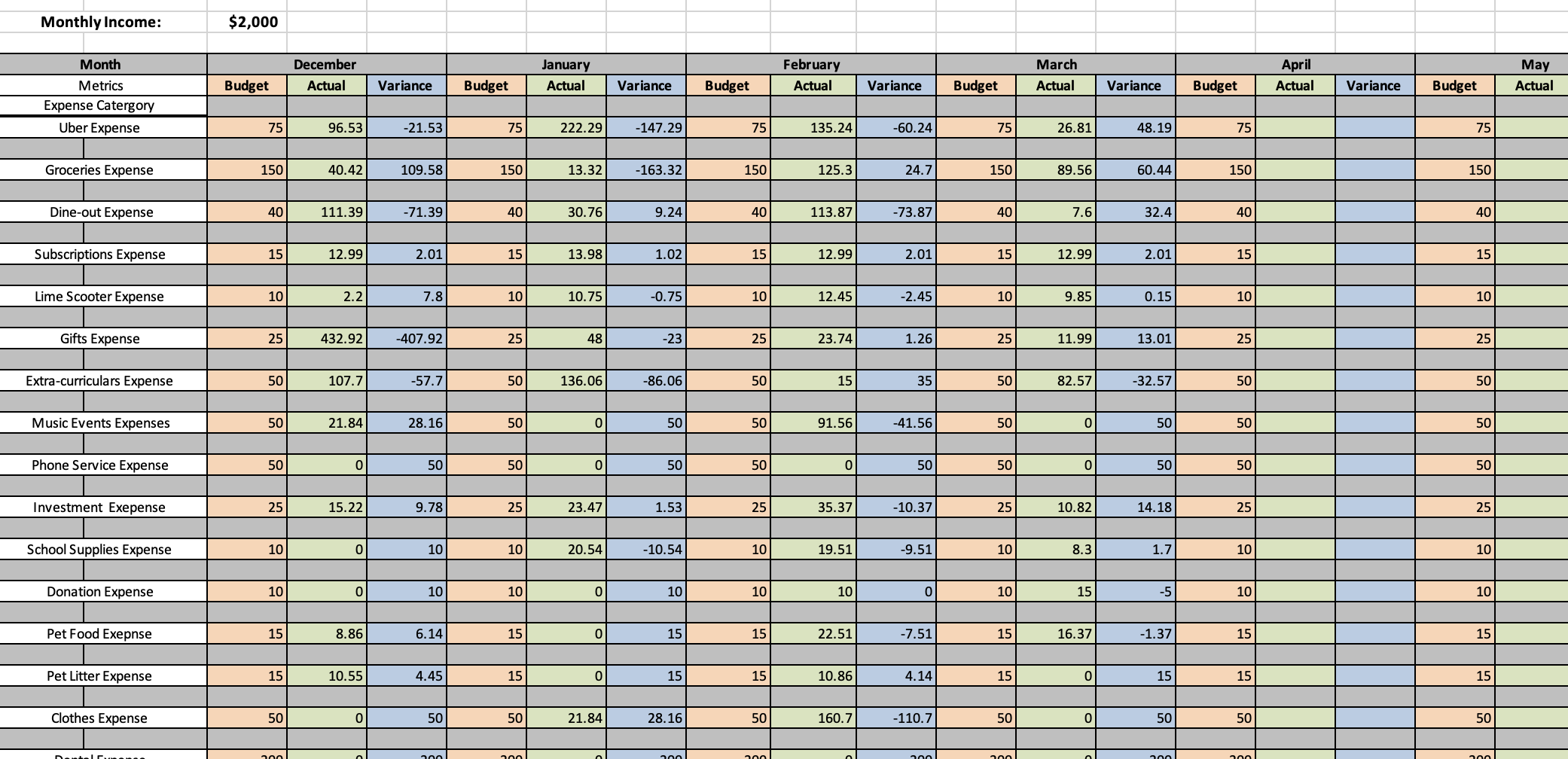

Household Budget - Appendix Figure #1

The goal of this project was to practice the concept of forecasting a cash flow budget for my own personal use and for a topic that I found interesting or had a vested interest in.

Step 1: Download and import my own bank statements to Excel and clean the data to be organized and easy to manage for future steps.

Step 2: Categorize the data and sum the totals for each month. Thus, each month would have a total expense and each category would have a total expense for the year and month.

Step 3: Create the budget sheet. The observations were each of the categories of expenses, and each of the variables: Actual, Budget, Variance coincided with a specific month of the year. “Actual” expenses came from my bank data, “Budget” expenses were decided by myself based on my current cash flow and previous months total expenses. “Variance” was used to show if I had met a budget, was under budget or over budget.

Step 4: Created visualizations to display the category amount of actual expenses for December to March.

Step 5: Create a forecast of the budget of any topic you may have had a personal vested interest in. At the time, I was the Northwest YMCA’s Aquatics Coordinator, overseeing its swim lesson program. It was only fitting to perform a budget forecast and analysis on my own department as a way to bring real world value to the company but also to practice managerial responsibilities in an academic environment. Using data from the Aquatics Director, I was able to forecast the March and April’s group and private lessons budget.

Step 6: Create the budget for the department based on the forecasted number of potential participants in the program and the price per participant based on their membership status. I used variance in this analysis as well to see if the actuals, when they were officially reported, were over or under the forecasted budget I calculated. Budgeting for nonprofits entities is extremely important. These analyses need to be highly detailed and produced with extreme due diligence as they are used to plan the entire year of operations for that non-profit entity.

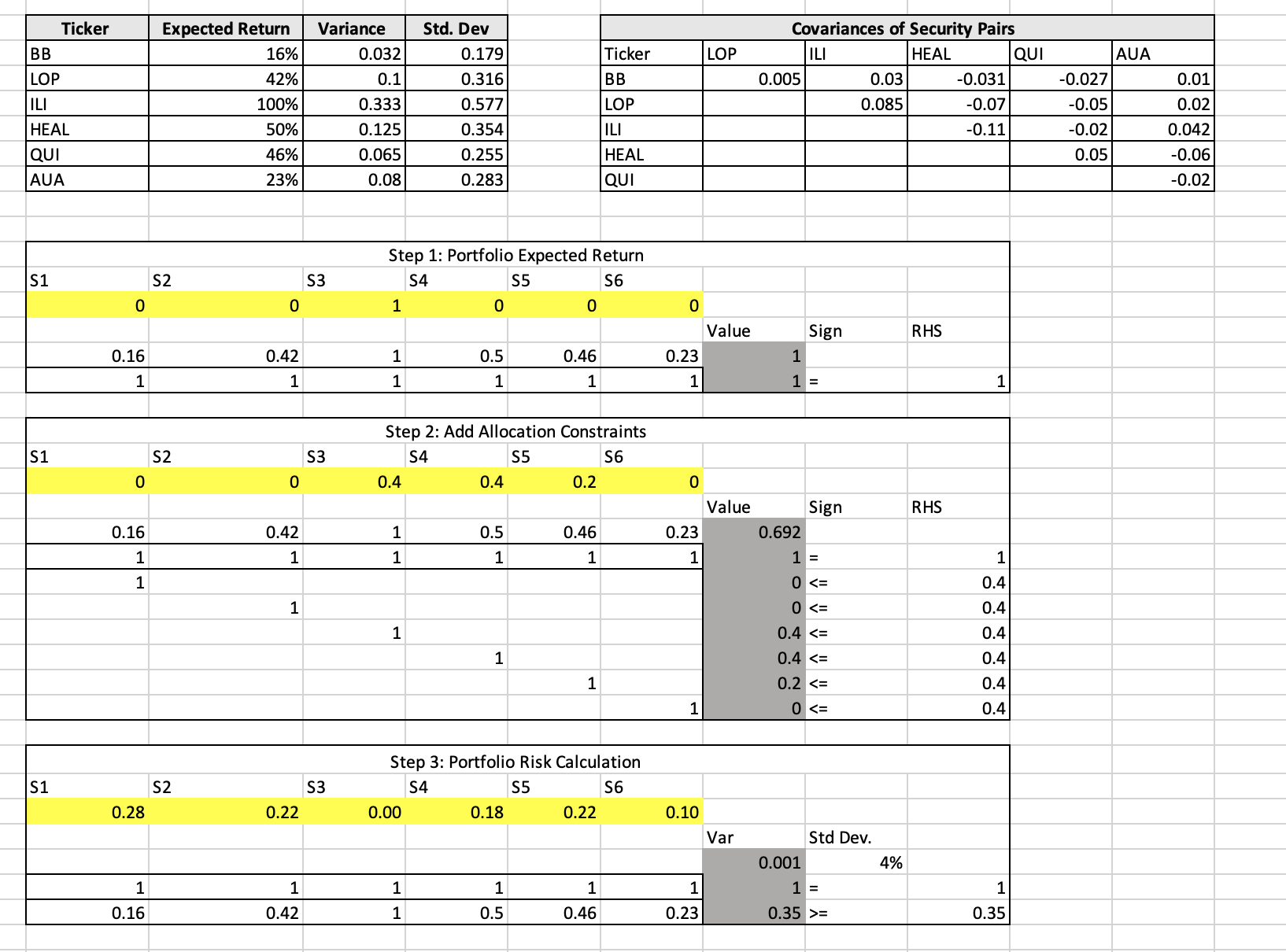

Portfolio Management - Appendix Figure #2

This assignment was part of my major specific class “Business Analytics” in which I was studying and practicing different portfolio risk management principles. Within the equities market, each stock can be assigned a beta or in our example, the standard deviation of the security. The beta shows how much the underlying security will move in a spcifc direction relative t the entire market price movement. The variance (standard deviation squared) is how much the price deviated from the mean in either direction, not just increased OR decreased. However, securities can also have covariances or relationships to each other that are positive and negative. To construct a portfolio with variance risk accounted for, you must develop a model that can provide risk adjusted allocations based on expected return, variance, and covariance values.

Step 1: Six fictitious equities with their own beta’s outlined and the relationship coefficients they have to each other were given in the prompt.

Step 2: First, we are tasked with seeing what a portfolio model would return for allocations based on a risk-free environment of each of the securities. The outcome obviously is not adequate as the model just returns the highest expected return with no risk varibles inputed. The only constraint in the portfolio was to have a 100% allocation of each of the six securities.

Step 3: Now, we construct a model that provides constraints in the amount of capital each security can feasibly receive. Each security is given its expected return based on normal market conditions, with each constraint of maximum allocation. The model returns a portfolio with an expected return of 69.2% based on that composition of securities. Again, this portfolio is unrealistic as it does not incorporate any market risk in the calculations.

Step 4: The final part of this portfolio risk calculation is to use the variance of each security with the covariances of the pairs to produce a portfolio with a specific risk level and expected return. The model uses each of the expected returns for each security as the constraint for overall portfolio expected return. The second constraint provides that the portfolio allocation cannot exceed 100%. The objective function uses a custom formula that can calculate the entire market risk of the portfolio of securities given each securities variance and covariances.

- =SQRT(S1(Portfolio Allocation)…S6(Portfolio Allocation)) ‘+’ 2*(S1’s Allocation * S2’s Allocation * Covariance for S1 & 2) … (S5’s Allocation * S6’s Allocation * Covariance for S5 & S6)

The model returns the overall portfolio variance of the basket of securities chosen by the objective function and constraints.

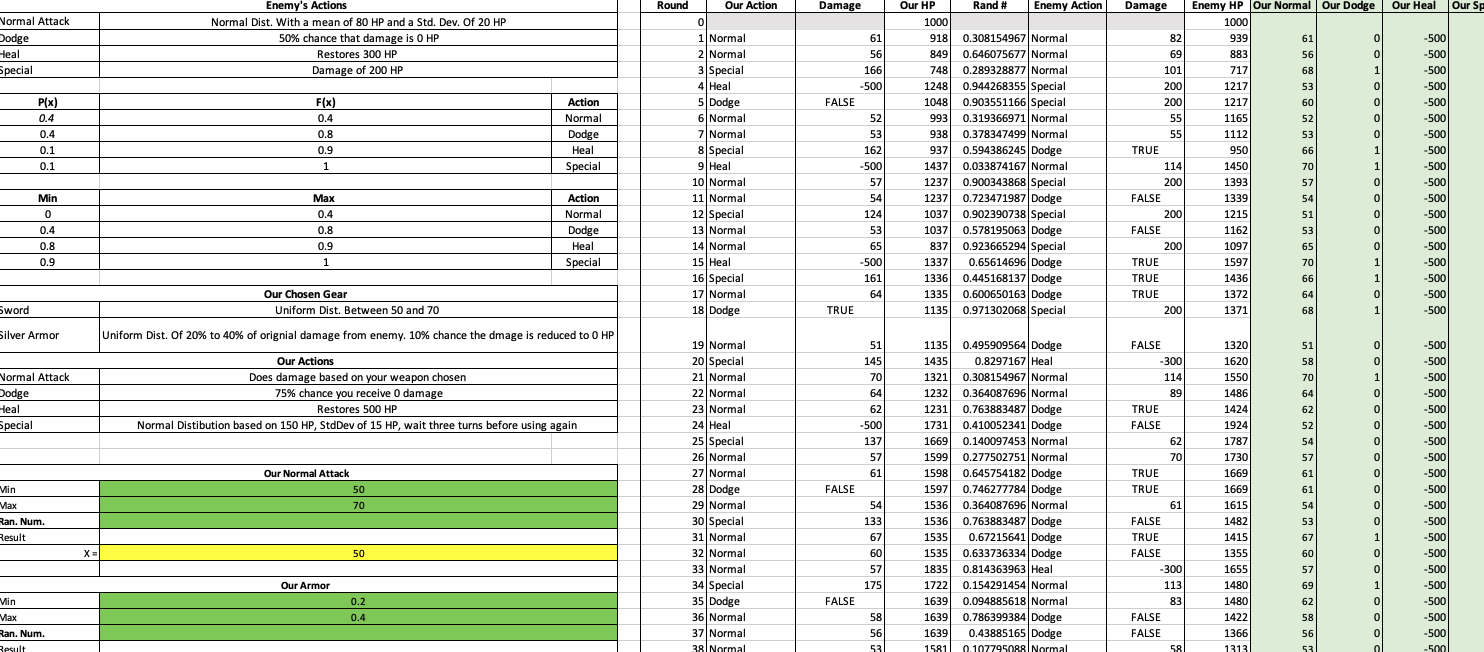

Video Game Simulation - Appendix Figure #3

Simulation Theory is an important aspect of analytics as understanding the concept of it allows for predictive modeling. Predictive analytics assists in forecasting different events and their outcomes such as revenue projections, cost reductions over time, weather, supply chain transportation times, etc. This project consists of building a turn-based game model in Microsoft Excel that uses probability distributions to determine what kind of event occurs in the “game.” I was allowed to choose specific equipment for our character. These different equipment used different probability distributions and had different effects.

- Examples: the “sword” or the “bow and arrow” which used uniform or normal distribution, respectively.

How the game was configured is that you create formulas using the =IF() function to provide the model the ability to determine what event should be happening based on the probabilities of the events that can occur for my character and the opponent character.

Then, use the =RAND() function to create random numbers to be the variable that dictates which event occurs based on the probabilities. I used the =RAND() function to calculate the strength of each event that occurred using the formulas provided with the event.

- Example: random number used to determine the value of normal attack with a uniform distibution between 50 and 70.

Once the model is set up, you can play a turn based game with the enemy character being completely controlled by the random numbers generated. I was in control of my character’s actions and was able to deplete the opponents health in 76 turns of simulation.

Stratgeic Managemnt & Virtual Study Abroad Program - Appendix Figure #4-7

In early Spring 2020, I applied and was accepted by the Global Studies Department to take part in the annual Business German Study Abroad Program. The program took the place of my Senior Capstone class “Strategic Management.” The class was divided into two main parts over the summer of 2020. The program was initially supposed to be in Germany but due to Covid restrictions, the program was moved to virtual delivery.

Files included:

- Midterm Presentation (#4)

- Final Presentation (#5)

- Conecta Sertao Project (#6)

- Technisce Hochschule Ingolstadt Certificate (#7)

The first section of the course was taught by SJSU faculty and was an overview of strategic concepts such as entrance strategies into emerging markets while also studying the structure of different multinational corporations. The main project for the course was a team-based report of the German Automaker, Porsche, in which we did a deep dive into their corporate structure and operations. After this section was complete, the team had to propose a strategy for entering an emerging market.

The second part of the course was taught by faculty of the German University; Technische Hochschule Ingolstadt. It lasted one month in which the class was lectured about the process of starting an entrepreneurial venture in the 21st century. Teams were divided into groups of 3-4 students ranging from Germany, India, Brazil and the United States. The mock business ventures had to align with one of the United Nations’ Sustainable Development Goals. My team chose to help solve the problem of food scarcity in Northern Brazil in the region of Sertao. The on-demand delivery application we devised was named “Conecta Sertao” in which the business model was a two-way marketplace for food producers and delivery drivers to connect and fulfill food deliveries across the region. The Sertao region is extremely barren in the west, yet rich in soil in the east. Our goal was to provide new avenues for delivering food from the east to western regions.

The conclusion of the course was after the teams presented their mock startups to a panel of professional German Venture Capitalists and proceed to enegage in a Q&A session which each of the panel members. The questions ranged from how would the team be able to streamline development of a two way marketplace bringing suppliers and delviery drivers on the application simultaneously, to how the team calculated and forecasted the revenue projections for the next several years. Overall, great experience being able to work with international students and have expsosure to business leaders from Germany developing a project from the ground up. This experience truly felt as if I was embarking on my startup journey and it provided great practical experience.

Appendix: Excel Projects

Household Budget Excel File (#1)

Portfolio Management Excel File (#2)

Simulation Theory Excel File (#3)

Appendix: German Study Abroad Program Files

BUS 189 Final Presentation (#4)

BUS 189 Midterm Presentation (#5)

THI Summer School Final Project (#6)

THI Summer School Completion Certificate (#7)