Crypto Blog Posts

Crypto Blog Posts

Blog Post #1 - DAOs: The What and The Why

April 12, 2022

Blockchain Technology’s Applications

The emerging technology of blockchain has grown in popularity and importance in the last several years. Blockchain technology is, in essence, an innovative database solution with varied real-world applications. A blockchain’s main purpose is to provide trustless and transparent database infrastructure that cannot be hacked due to its distributed properties. Blockchain’s key value proposition is to eliminate the counterparty risk associated with using intermediaries in different types of transactions between two willing parties.

Blockchain use-cases are quite abundant and can be seen as improving the old ways of doing business. It facilitates a new decentralized finance concept, called “DeFi” in which market participants can lend, borrow, stake, or earn yield on their digital assets. NFTs or “non-fungible tokens’” have allowed the creator economy to find new ways of monetizing their content and realize all the value associated with their work. Blockchain and digital assets have an application in the global remittance market allowing people to send money back to their families in other countries, effectively at a near-zero cost and settled almost instantaneously.

However, there is one innovation in this space that I want to discuss more prominently. The creation of “smart contracts.” According to Investopedia, smart contracts are

“self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.”

Smart contracts allow for trustless contracts, operated by the coding housed within a blockchain. They facilitate a transaction between a willing buyer and seller, and once the code is written, it is distributed through the blockchain. Therefore, it cannot be tampered with or changed (unless agreed upon by the community governing the blockchain – but we will get to that in a minute.) These smart contracts, in my opinion, are what give the associated blockchain its value. No longer must users interact with high fee, non-transparent, highly-bureaucratic intermediaries. These users can simply use a blockchain to facilitate their transactions without needing to know the other party involved. The smart contract will make sure the transaction is executed appropriately and fairly.

Now, besides the trustless facilitation of financial transactions, what else can a smart contract do? Smart contracts have created the ability to formulate an internet-native community governed solely by its own members. This is called a DAO or a decentralized autonomous organization.

What is a DAO?

The Ethereum Foundation, which governs the Ethereum blockchain stated that a DAO is an:

“internet-native business that’s collectively owned and managed by its members. They have built-in treasuries that no single entity has the authority to access without the approval of the group. Decisions are governed by proposals and voting to ensure everyone in the organization has a voice.”

DAOs, effectively, are purely digital treasuries that serve a specific purpose for those community members and are governed by the code that was used to construct it, – hence the need for smart contracts. These internet-based organizations can only be controlled by those in the community, usually through a governance mechanism. These community members approve or propose new ways the DAO is to operate. Typically, DAO’s offer membership by selling a token associated with the governance of the DAO to market participants who wish to aid and use the platform’s functions.

Let me put this application of smart contracts into perspective. First, we had “Web 1”. During this time of the internet’s maturity, users could view digital content, curated by various entities in a “read-only” medium. “Web 2” came around when users of the internet could now begin to create their own content and interact with others across the globe. Social media is a large aspect of the emergence of “Web 2.” “Web 2” also came with the centralization of power in internet corporations such as Facebook and Google. So, where do DAOs fit in? Blockchain is driving the third iteration of the internet - amply named Web 3 - where we have now created a decentralized governance model for the internet, allowing the internet to effectively govern itself. Smart contracts are created to obey the instructions of the code, allowing these emerging internet-native communities to build new business models and use-cases, all in a trustless and distributed manner. DAOs will play an integral role in facilitating the applications of a decentralized internet.

Example of DAOs

These three examples of what a DAO could look like are some of the unique ways I see this model being used. As time progresses, we will see DAOs being used in ways we haven’t thought of yet. This is why DAOs will be so powerful for this new digital global economy we see growing in prominence year after year.

Local Community Treasury: DAOs offer the infrastructure for users, such as local citizens, to pool their existing capital together and vote on ways that the money can be used to support their community’s well-being. Every community is different and requires different needs to be fulfilled. The DAO would provide a solution where the people who know best could create funding for repairs of roads, creation of local food production, beautification of area, and other crucial areas of interest for their community. As we progress as a society, decentralization and localization will become paramount in dealing with various local community-related problems head on and DAOs inherent functionality can provide a solution.

Shared Investment Vehicle: The characteristic of a shared internet treasury can be applied to investments and allow those who have not been able to participate in traditional finance, a way of becoming exposed to various financial markets. Anyone with an internet connection can participate in DAO activity as many of the “on-ramps” for various blockchains are simply downloaded from the internet onto your computer and/or smartphone. These “on-ramps” come in the form of digital asset wallets that allow you to interface with a blockchain’s ecosystem. Let’s say a prominent and highly respected financial YouTuber wants to build a way for her community members to share in her wealth and knowledge. She pools together developers and creates a DAO which her community members can invest in. Through the governance model outlined in the smart contract, the newly established investment community can propose and approve of investments that will benefit everyone in the DAO ecosystem. The DAO will not be constricted by geographical borders and can have immense reach to any willing participant. Now, I am no investment advisor or lawyer, and regulations may be a factor in this becoming true. However, I see the digital asset and blockchain space growing in maturity and recognizing its true potential in years to come. One day we will see the barriers to financial markets stripped down and curated to allow for open participation from all around the globe.

Disaster Relief Fund: With increases in climate change and shifting of weather patterns, regions all over the globe are becoming more susceptible to devastating climate events. Loss of agricultural production, tsunamis, hurricanes, and loss of biodiversity are just to name a few that can have negative impacts on already fragile global communities. After these communities have been affected by these deadly climate events, monetary relief is needed to improve the communities well-being. The smart contract characteristics of a DAO would ensure the trustless delivery of these funds to community leaders that can begin to rebuild what they have lost. We saw during the initial stages of the 2022 Ukraine-Russian War, digital assets were used to aid the Ukrainian people quickly and efficiently. Without the need for intermediaries, the risk of stolen or misplaced funds is negated and all value can be given to those in which the funds were raised.

Why we need the DAO model to succeed

DAOs are going to change the way we view and engage with businesses and communities. The World Economic Forum states,

“DAOs offer the promise of enabling a focus on community, rather than just profit, and might offer a more socially-conscious structure.”

The DAO innovation will strip away the hierarchical and bureaucratic structures that have defined society for decades and give power back to the ordinary person by allowing them to participate in communities that serve their needs in a decentralized manner. From DAOs offering new ways for people to invest all the way to pooling donations quickly for humanitarian efforts, the use-cases are just becoming established and with time, we will realize the value they will bring into our world.

Sources

Ethereum Foundation: Decentralized Autonomous Organizations

Investopedia: Definition of Smart Contracts

World Economic Forum: Why we need DAOs

Blog Post #2 - Global Disruption & Bitcoin

May 7, 2022

Bitcoin’s Characteristics

Bitcoin is a decentralized, peer-to-peer, digital monetary network, founded by psuedoanonymous Satoshi Nakamoto after the financial collapse in 2008 due to unbridled greed on Wall Street. Bitcoin operates 24/7, as “miners” give the network computational power to process transactions in exchange for newly minted bitcoins. The network spans the globe and has major mining operations dispersed throughout many different regions. Bitcoin is fully transparent as it acts as a distributed ledger, keeping information on transactions recorded and visible to the public. Bitcoin has no need or want to exclude anyone from operating within its ecosystem. It is governed by its original code and will forever be. These characteristics are what bring Bitcoin its value today as an alternative to our traditional banking system.

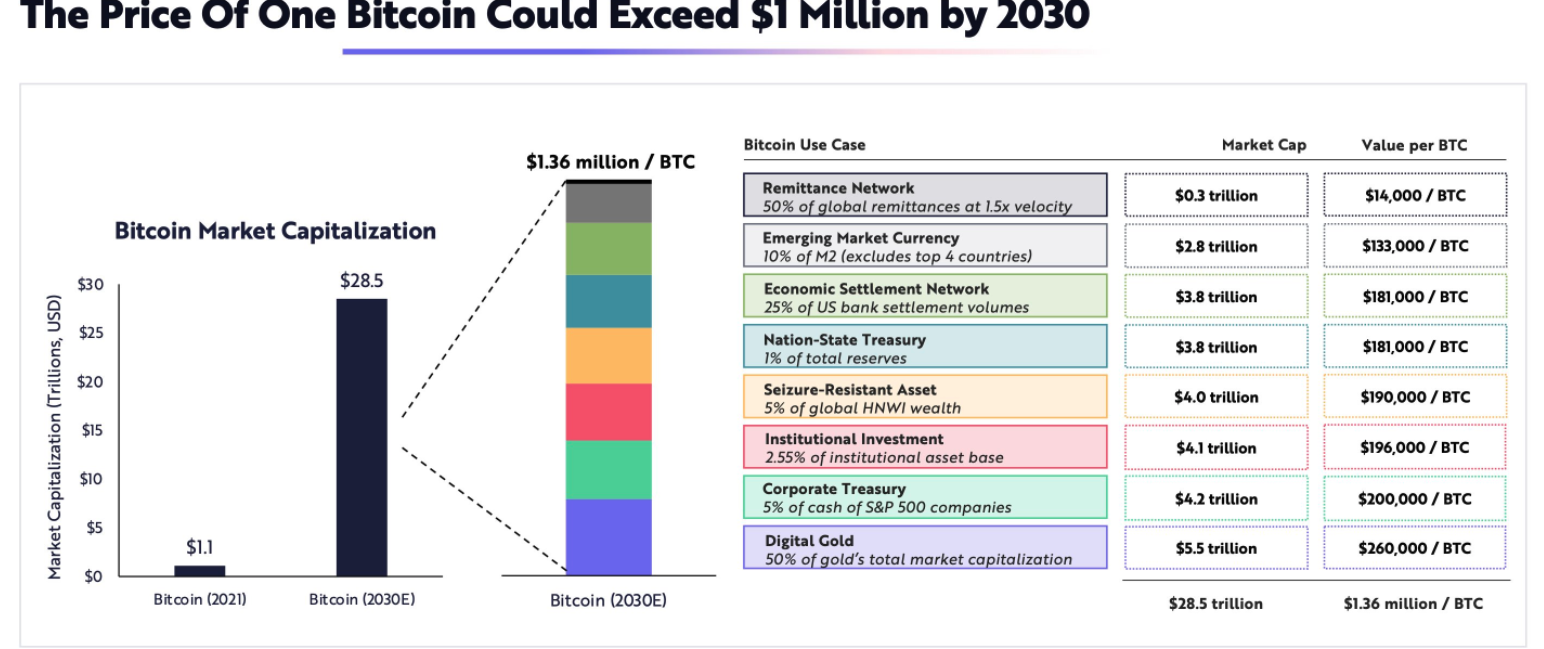

Bitcoin over the years has become highly financialized. New bitcoin-backed financial products are being created and traders are buying and selling the asset for a profit. Effectively when purchasing bitcoin, you are buying the rights to operate in the system. There will only be 21 million bitcoins ever mined into existence, making the rights to operate in the system scarce and limited. Market participants and pundits have predicted the price of Bitcoin over the years as this new asset is the best performing asset over the last decade. ARK Invest, a large-scale institutional investor of technology, operated by Kathie Woods has stated that the price of a single bitcoin could surpass $1,000,000 by the year 2030.

This article is to outline the ways that Bitcoin could feasibly reach this target price using ARK Invest’s data. The price of a single bitcoin should have no real merit in the success of the technology. It is a mere byproduct of the value it brings to real-world solutions. Bitcoin is a way for those who have been shunned out of the traditional finance space, to begin to connect to global markets and access a new method of storing and exchanging value.

The Eight Global Markets

ARK Invest outlines eight different global use-cases Bitcoin could disrupt. Each of these different segments allows Bitcoin to capture some of the value being generated by those markets. The next sections will cover what the market is, how Bitcoin could disrupt the market, and where will it take the price of BTC in the eight years.

Remittance Market: The remittance market can be summarized as the flow of value, from an abroad sender back to their domestic beneficiary. As migrants from other countries move to employment abundant nation-states, they can send money back to their families. Typically, they send this money through a large, centralized money network operated by Western Unions or MoneyGram as an example. These corporations charge high fees to send this money abroad and diminish the actual value that is finally realized domestically. Bitcoin offers a low-cost, almost instantaneous payment that cannot be stopped due to its decentralized nature. If Bitcoin could be the global remittance payment network, the flow of value could be expanded and begin to support other communities around the globe. ARK Invest believes that Bitcoin could capture 50% of the market, adding roughly $14,000 to the price.

Emerging Market Currency: According to Investopedia, an emerging market is “a developing country maturing and its economy beginning to interface with the global economy more and more.” An emerging-market currency would be the currency that facilitates transactions for these developing nations. Currently, we have had two nation-states adopt BTC as their legal currency, El Salvador and The Central African Republic, in 2021 and 2022, respectively. In El Salvador’s case, the adoption of BTC was a way to fight the devaluing of the US Dollar, as this is the main form of exchange in the country. During the pandemic, the US Federal Reserve printed trillions of US Dollars to stimulate our own domestic economy. What would happen if you never received any of that stimulus? Now, El Salvador is using BTC as a way to collateralize loans to build infrastructure and developments. Due to Bitcoin’s characteristics, it serves as an excellent monetary network for these countries as they come “online” and began to compete in the global markets. Market participants can use this low-cost transfer medium to send funds through their economies quickly and with transparency. Bitcoin also allows these countries to trade with other countries frictionlessly as Bitcoin can be converted into any other currency, very similar to traditional foreign exchange trading markets. ARK Invest predicts Bitcoin capturing 10% of the M2 money supply, giving $133,000 value to the price of a bitcoin.

Economic Settlement Network: As our world becomes more globalized, countries and companies have an increased need to transact across national borders. The Bank of International Settlements is a central bank for the global economy and is owned by 63 national central banks. The Bank of International Settlements helps facilitate large-scale transactions occurring through different currencies. Bitcoin can offer a decentralized alternative for cross-border payments and allow all countries to operate in the global landscape. Bitcoin is a slow yet extremely robust and secure network. Its design can handle these large transactions with ease, making it an suitable alternative to a centralized global entity. ARK Invest predicts Bitoicn will capture 25% of just US global trade volume and add $181,000 to the price.

Nation-State Treasury: During the pandemic in 2021, the U.S. Congress passed the largest stimulus spending package ever in the history of the country of $1.9 trillion. The Federal Reserve began buying up open-market securities to provide the banks with more money for lending. In a fiat-based currency system, like the U.S., when there is more currency in circulation and unchanged or decreased amounts of goods and services in the economy, the value of the currency debases. Effectively, there is more money chasing the same amount of goods. Prices have to increase and inflation ensues. Bitcoin is a scarce, digital asset that allows you to interact with a global monetary network. Nation-states could purchase bitcoins in order to protect their currencies’ purchasing power against inflation. ARK Invest sees Bitcoin capturing 1% of the total currency reserves and adding $181,000 to the price.

Corporate Treasury: Similar to the “Nation-State Treasury” use case, companies are seeing their cash reserves devalued over time. Their purchasing power is decreasing as the domestic currency these companies use is debasing due to inflation. Companies must continue to provide goods and services in order to continue operations, and they receive their domestic currency as payment. With the ability to diversify their treasury assets with Bitcoin, they can better hedge against the destructive properties inflation brings. ARK Invest predicts Bitcoin could replace 5% of cash reserves in the S&P 500 and add $200,000 to its price.

Seizure-Resistant Asset: In the field of economics, the true driver of economic growth is the ability of the population to own property and be incentivized to use that property for economic value. In many countries around the globe, these nations have a less favorable environment for property rights and their economic prosperity has been severely affected. Bitcoin can be secured using hardware wallets that protect your private keys and take your assets off-chain. This can allow certain populations to own a piece of a decentralized monetary network and have their wealth appreciate over time. However, coercion is a factor that could lead to the seizure of digital assets and bitcoin. In this hypothetical situation, your assets were jeopardized by external factors. In the base case, bitcoin is one of the most highly secure assets you can possess. ARK Invest predicts Bitcoin will capture 5% of the global high net-worth individual wealth and add $190,000 to the price.

Institutional Investment: Institutional investors, such as pension funds, serve a specific purpose for our economy. These large-scale investors seek to grow their asset base over the long run in order to meet their obligations in the future. CalPERS, or California Public Employees Retirement System is a pension fund that manages $360 bil. in assets to provide for public employees’ pensions and healthcare benefits. These investors look to make strategic allocations that will provide the necessary funding for their liabilities. Bitcoin is a way to diversify their long-term holdings and effectively provide their service. ESG standards are another factor that plays into institutional investment. ESG, or Environment, Social, Governance factors are guidelines that institutional investors look to meet in each of their allocations. Bitcoin currently lacks ESG approval due to its energy consumption. As the industry matures, energy technologies will begin to innovate to efficiently power the Bitcoin network. ARK Invest predicts Bitcoin will capture 2.55% of the institutional asset base, adding $196,000 to its price.

Digital Gold: The U.S. was taken off the gold standard in 1971 by President Nixon. This gold standard outline that each dollar in the U.S. Treasury was backed by physical gold. If the money supply was to expand, the U.S. Treasury and Federal Reserve would have to purchase more gold to collateralize that new issuance of U.S Dollars. With this standard gone, the government transitioned into a fiat-based monetary system where the U.S. Dollar is supported by the promise that this asset is worth the amount it is stated to possess. Bitcoin offers many of the same properties gold possesses, but expands on them and is suited for a truly digital economy. Bitcoin‘s supply is finite. Only 21 million bitcoins will ever be mined, meaning ownership in the Bitcoin network is scarce, and only willing market participants will be the ones able to interact with it. Bitcoin can be used as a medium of exchange. Bitcoin holds monetary value and if someone is willing to accept it, goods and services can be paid for using bitcoin. Bitcoin is a store of value. This again aligns with the scarcity of ownership associated with the network. As more buyers begin to purchase bitcoin, the monetary value will increase and preserve your wealth over time. ARK Invest predicts Bitcoin will capture 50% of gold’s market capitalization and add $260,000 to its price.

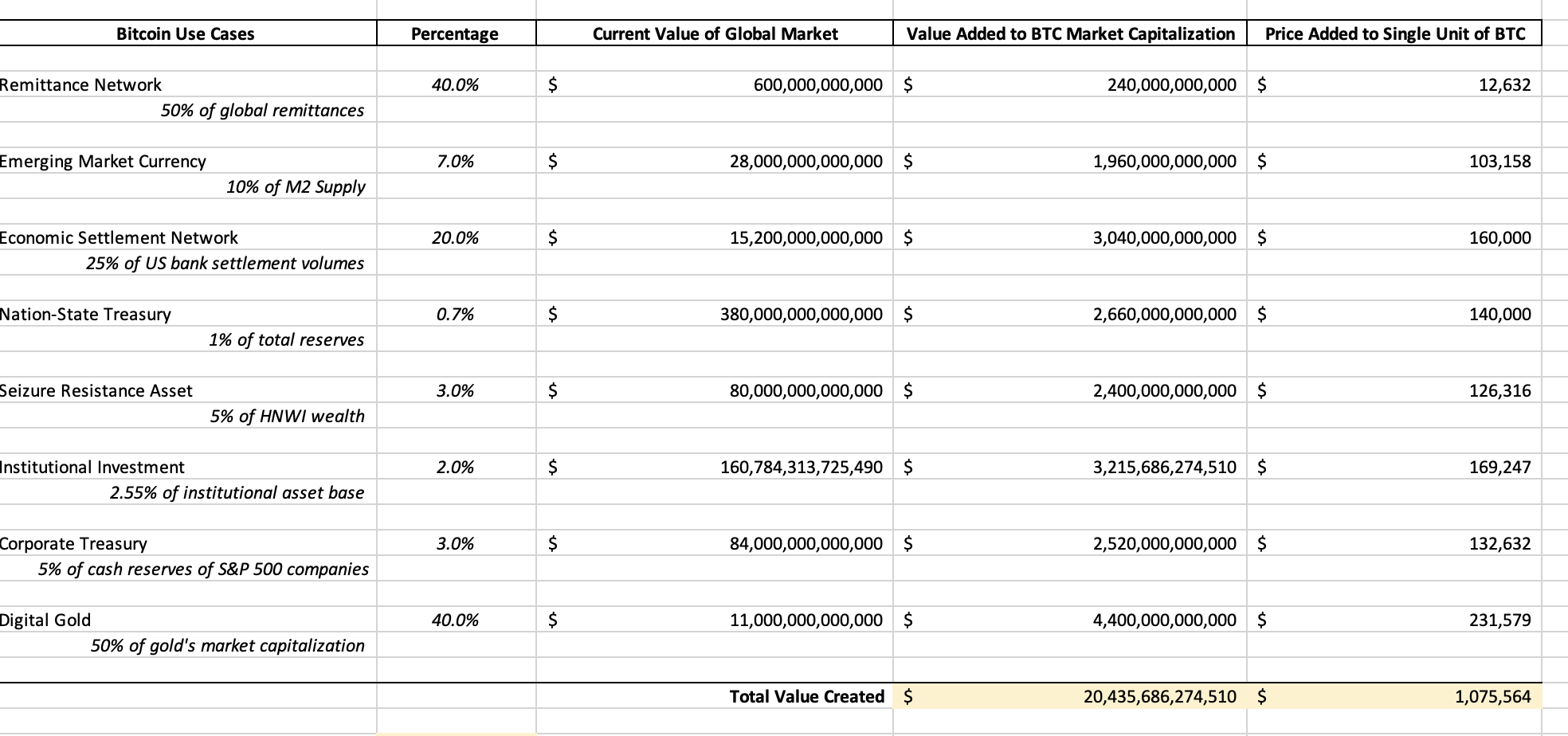

Bitcoin’s One Million Dollar Price Tag Model

In order to add to ARK Invest’s forecast for the price of Bitcoin, I have developed a simple model that allows the user to test different assumptions. The model uses the current values outlined by ARK and can be changed using a dynamic toggle that will change the percentages captured by Bitcoin. There is also a sensitivity table that can summarize your findings and compare the assumptions you are testing to the original forecast outlined by ARK Invest.

Bitcoin Price Model

Bitcoin is one of the most influential innovations of our time. Payment networks are nothing new to our global economy and have been around for decades, allowing people to seamlessly transact for goods and services. The innovation comes from the economic incentive and decentralized nature that is inherent in Bitcoin’s security and operation. Satoshi developed a way to create a trustless monetary network where self-interested participants can contribute to the entire growth of the network, all while being highly secure and inclusive to all.

Sources

Bitcoin: Best Performing Asset

Yassine Elmandjra - ARK Invest

Blog Post #3 - Cardano's Staking Industry

September 2, 2022

Introduction

Blockchain technology and its application in cryptocurrencies and digital assets have led to the emergence of truly digital business and economic applications. Decentralized finance allows market participants to use their assets to lend and borrow other various assets and earn yield. Blockchain can create digital identification that can allow users to have a true economic identity in the global markets. It also has led to new industries in the propagation of blocks. A block is a batch of transactions that occur on the blockchain and once verified, it becomes final in the blockchain and cannot be revoked. One of the most important innovations to come to this space is the ability for market participants to earn passive income, not from the yield on their assets, but from “staking” their assets to a blockchain. This article will focus on “proof-of-stake” in the Cardano ecosystem and the blossoming industry it has created. To understand this industry and the opportunities within, we must discuss what staking is and how it differs in its operation from the first and most prominent consensus mechanism, “proof-of-work.”

Consensus Mechanisms

“Proof-of-work” (or POW) was pioneered in the bitcoin blockchain as the method for aligning economic incentives for the network and helping provide security and verification of bitcoin transactions. POW uses computers connected to the network to provide computational power, also known as hash rate, to process transactions by solving complicated mathematical equations to verify a block. These computers compete with each other to solve these problems in order to be the first to find the answer. When they solve the problem, they are given the privilege to propagate the block onto the network and receive a block subsidy, which is currently, 6.25 bitcoins.

In a work of genius, bitcoin’s network algorithm will increase the computational power needed to solve the equations when more hash rate becomes available on the network, which has been called the “difficulty adjustment.” This is to prevent one or a group of computers from controlling the majority of the network. Bitcoin has created a new industry for providing computing power and electricity use for the verification and security of a decentralized global monetary system. However, as the demand for bitcoin has risen, so have the costs of becoming a bitcoin “miner” or a computer providing hash rate. Environmental concerns have also risen due to the energy consumption of bitcoin mining. Bitcoin currently uses 110 terawatt-hours per year - equating to 0.55% of global electricity production.

As per the large start-up costs and the energy consumption from the bitcoin network and other proof-of-work cryptocurrencies, a new consensus mechanism has started to grow into prominence in newer blockchains. “Proof-of-stake” (or POS) turns miners into validators where these validators operate servers that act as the blockchains’ nodes that process and verify blocks. These validators lock up market participants’ stake, or the amount of the network’s native asset, to incentivize the long-term holding and growth of the asset. This method doesn’t work like POW as more stake does not articulate directly into more computational power in the network. Rather, staking aligns economic incentives for more validators to join as holding more native assets can bring greater returns for investment, therefore bringing more servers to the network, adding more decentralization and security.

These mechanisms of consensus work differently but come to the same conclusion. The network reaches an agreement on transactions and a new block is propagated. POW uses more energy but makes it extremely costly to act against the network as the costs of mining are high while POS uses less energy but allows more market participants to engage with the longevity of the network.

What is Cardano?

Cardano is the blockchain that I will be focusing on to illustrate the benefits of staking and the potential new business models that can be created through staking. Cardano is a “third generation blockchain” which is defined as a blockchain that is superior in technology and is built for the new challenges blockchains face in today’s marketplace. Cardano is being developed by Input-Output Global and other various companies, headed by Charles Hoskinson. In my eyes, Cardano was built for the sole purpose of democratizing global finance and “banking the unbanked,” a popular ethos of cryptocurrencies and digital assets.

Cardano’s Key Metrics:

- Circulating Supply Staked: 70.68% (~$11.12 bil)

- Projects Being Built on Cardano: 1003

- Decentralized Treasury Holdings: $ ~1 bil. ADA (~500 mil. USD)

- Ouroboros: Best-in-class Staking Protocol

- Stake Pools/Validators: 3204\

Staking is one of the most integral aspects of the Cardano ecosystem. Cardano uses a novel consensus protocol named Ouroboros to provide the staking services to market participants. Ouroboros allows users to stake ADA, Cardano’s native asset, in a completely liquid state. In other networks, like Ethereum and Solana, these assets are locked up and taken off-chain, while Cardano instead keeps all tokens on the network. Cardano accomplishes this by using the user’s private keys to assign ownership of the staked tokens. This is why you can always liquidate your stake in Cardano, as the tokens live actively on the network as they are staked. Users can earn a return on their investment while also being able to quickly react to market dynamics as they have full access to their assets at all times. A truly inspiring application of staking.

Stake Pools

Stake Pool Operators or SPOs are the validators that process Cardano’s transactions and are rewarded with block subsidies and transaction fees. As mentioned above, Cardano’s current number of validators on the network is 3204, which allows for an extreme case in decentralization and security. Cardano has seen success in growing its validator base because of its saturation mechanism. Simairlity to bitcoin’s difficulty adjustment which makes it harder to solve the “proof-of-work” as more hash rate enters the bitcoin network, Cardano’s stake pools will adjust rewards dynamically as more stake is invested into each pool. As more stake is invested, the pool becomes saturated and this process incentivizes more pools to be created as the returns on investment diminishes. As the return on staking ADA decreases, more validators set up operations to fulfill the demand for their stake pool. More validators competing for transactions increase decentralization and more servers hosting Cardano’s protocol means more security. This creates a positive economic feedback loop for the network.

Social Good Meets Return On Investment

A new emerging business model can be utilized within the Cardano ecosystem. Running a stake pool is a business endeavor, and should be treated as such to keep economic incentives aligned for network growth. The goal is to increase your pool’s stake to saturation, then open more pools to fulfill the demand for staking in your pools. However, there can be an alignment of social good and return on investment for staking on Cardano. I believe this is where the opportunity lies. As operating a stake pool, you are able to use profits made from operations to provide funds to social projects all over the globe. A great example of this is Digital Asset News and its stake pool operations. Currently, a certain percentage of all profits made from the stake pool is used on Kiva.org for micro-loans to businesses and citizens in emerging markets.

As our world has become hyper-digitized, it is even easier to engage with communities around the globe and support economic growth in these communities. This focus on social good from operating a stake pool can be used to incentivize more market participants to use their assets to help fund social causes and spread well-being across the globe. The opportunity is only just beginning as Cardano is slated for a major upgrade to its network in 2023, amply named Hyrda, (the mythological creature with many heads) which allows SPOs to act as sidechains (chains running parallel to the main chain, using the main chain as security). These SPOs can earn a return on their ADA but also the token of the sidechain, further increasing returns and the ability to help fund social causes.

Staking will continue to grow as the cryptocurrency and digital asset industry matures and more market participants enter the market looking for new ways of engaging in the global digital economy. Large corporations and institutions will enter as regulation is defined and the need to diversify investments away from traditional assets becomes more apparent. Cardano is setting a pathway for new businesses to emerge that bridge the gap between for-profit and non-profit endeavors, leading to a more just and equitable world for us all.